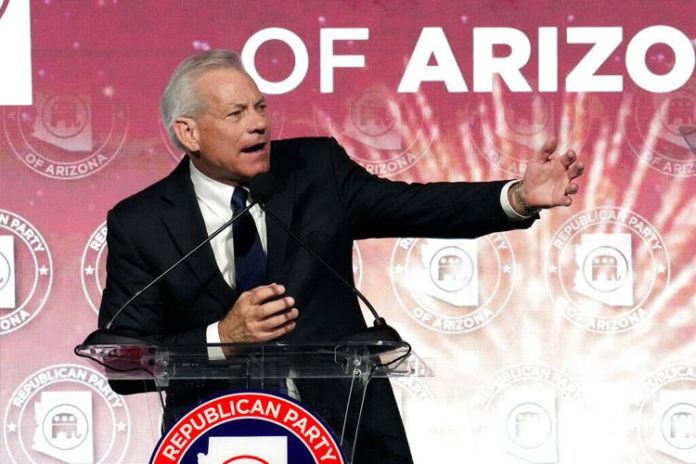

U.S. Rep. David Schweikert spoke against President Joe Biden’s call for an increased tax on stock buybacks following the State of the Union address.

“President Biden failed to mention that American families are poorer today than they were even a year ago,” Schweikert said. “In his speech, the President proposed a 4% tax on stock buybacks, which won’t help families struggling to afford goods at the grocery store and gas at the pump.”

Stock buybacks are used by corporations to buy shares of their own stock. When the company buys its own shares, it increases the stock value, and, thus the return on investment for shareholders. The current tax rate upon buybacks, passed by Congress a month ago, is at 1%.

“This tax on American retirement savings will decrease investment in the tools our workforce needs to modernize our economy, and it will ultimately lower living standards for Americans,” Schweikert said. “Inflation-adjusted wages are down 4% since President Biden took office, and this tax would decrease wages by 3% over the next decade.”

In contrast to Schweikert’s focus on 401ks, Biden reflected upon corporate profits.

“You may have noticed that Big Oil just reported record profits,” Biden said. “Last year, they made $200 billion in the midst of a global energy crisis. It’s outrageous. They invested too little of that profit to increase domestic production and keep gas prices down. Instead, they used those record profits to buy back their own stock, rewarding their CEOs and shareholders.”

Schweikert argues that the shareholders Biden spoke of include everyday Americans. The congressman serves on the Ways and Means Committee and as the lead House Republican on the Joint Economic Committee.

Republished with the permission of The Center Square.